Recent Blog Posts

Avoiding Family Fights After You're Gone: Why Your Trust Should Include Flexibility and Safeguards

Nobody wants to imagine their children fighting over money after they pass away, but it happens more often than most people realize. Even families that seem close can end up in bitter disputes over inheritances. The good news is that a well-designed trust can prevent many of these conflicts before they start. By including flexibility and safeguards in your estate plan, you can protect both your assets and your family relationships.

Nobody wants to imagine their children fighting over money after they pass away, but it happens more often than most people realize. Even families that seem close can end up in bitter disputes over inheritances. The good news is that a well-designed trust can prevent many of these conflicts before they start. By including flexibility and safeguards in your estate plan, you can protect both your assets and your family relationships.

Creating a trust in 2026 is not just about deciding who gets what. It is also about anticipating problems that might come up years from now. With 20 years of experience, our Aurora, IL estate planning attorney has seen these problems and can help you guard against them.

Why Do Families Fight Over Estates and Trusts?

Estate disputes often happen for predictable reasons. Sometimes one child feels they deserve more than their siblings because they provided caregiving or stayed closer to the parent. Other times, family members disagree about whether the person who created the trust was mentally capable of making decisions at the time. Blended families can create particularly complicated situations when children from different marriages feel they are being treated unfairly.

What You Need to Know About Probate in Kendall County

Losing a parent is one of the toughest things most of us will ever experience. During this difficult time, you may hear the word "probate" and wonder what it means for you and your family. Probate is the legal process that settles a deceased person's estate. Understanding the basics can help you know what steps to take next and whether you need legal help.

Losing a parent is one of the toughest things most of us will ever experience. During this difficult time, you may hear the word "probate" and wonder what it means for you and your family. Probate is the legal process that settles a deceased person's estate. Understanding the basics can help you know what steps to take next and whether you need legal help.

Our Aurora estate planning and probate attorney offers free consultations and has over 20 years of experience guiding families through this process. We can help you manage your parents’ estate in 2026 so you can focus on your family.

What Is Probate in Kendall County, IL?

Probate is the court process that transfers your parent's assets to their beneficiaries after death. The Kendall County Circuit Court oversees this process. During probate, the court makes sure your parent's debts get paid and their remaining property goes to the right people.

How to Avoid Probate When You Inherit Real Estate in Illinois

If you have watched your family argue over property after a loved one passed away, you know how painful that experience can be. Indeed, a survey by Caring.com estimated that fewer than 25 percent of Americans die with a will, the most basic estate planning tool. This causes problems – even tragedies – for many families.

If you have watched your family argue over property after a loved one passed away, you know how painful that experience can be. Indeed, a survey by Caring.com estimated that fewer than 25 percent of Americans die with a will, the most basic estate planning tool. This causes problems – even tragedies – for many families.

Many parents and grandparents in Illinois want to make sure their children and grandchildren do not go through the same thing. The good news is that with the right estate planning tools, you can pass real estate to your heirs without the delays, costs, and conflicts that come with probate.

Our Kendall County estate planning attorney has over 20 years of experience helping families protect their property and their relationships. Call Gateville Law Firm at 630-780-1034 for a free consultation in 2026.

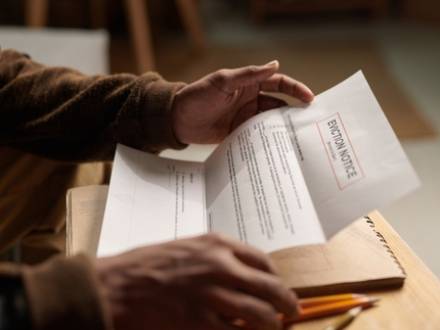

The Landlord’s Guide to Kendall County Evictions

For landlords and real estate investors in Kendall County, evictions are one of the highest-risk legal issues you will face. An eviction is not just about removing a tenant; it is a legal process that can expose you to counterclaims, delays, and personal liability if handled incorrectly.

For landlords and real estate investors in Kendall County, evictions are one of the highest-risk legal issues you will face. An eviction is not just about removing a tenant; it is a legal process that can expose you to counterclaims, delays, and personal liability if handled incorrectly.

At Gateville Law Firm our Kendall County real estate lawyer represents landlords in landlord/tenant disputes. We approach evictions as risk-management issues, helping you navigate the process efficiently while protecting your long-term wealth.

What Are the Reasons a Landlord Can Evict in Illinois?

In Kendall County, a landlord must have "cause" to terminate a lease early. Common legal grounds include:

-

Non-payment of rent (735 ILCS 5/9-209) is the most frequent reason for eviction

The Hidden Dangers of Joint Ownership and Transfer-on-Death Accounts

Adding a child's name to your house deed or bank account seems like a simple way to avoid probate. Many people believe this small paperwork change will make things easier for their families. Unfortunately, this shortcut is one of the most common estate planning mistakes, and it can create serious financial and legal problems that take years to fix.

Adding a child's name to your house deed or bank account seems like a simple way to avoid probate. Many people believe this small paperwork change will make things easier for their families. Unfortunately, this shortcut is one of the most common estate planning mistakes, and it can create serious financial and legal problems that take years to fix.

These quick fixes often override your actual wishes and expose your assets to risks you never considered. Our Aurora, IL estate planning attorney has 20 years of experience and can help you avoid mistakes like this. We start by making sure we truly understand your long-term goals, and then work backward to find great solutions.

How Do Joint Ownership and Transfer-on-Death Accounts Work?

When you add someone's name to a deed or bank account as a joint owner, you create what Illinois law calls a joint tenancy with right of survivorship. Under 765 ILCS 1005/1, this means that when one owner dies, the surviving owner immediately and automatically owns the entire asset. The same principle applies to transfer-on-death and payable-on-death account designations.

Why Proper Asset Protection Requires Professional Legal Help

You own investment properties; you set up an LLC online; you even signed a Living Trust. You probably believe your assets are protected. But a single paperwork error or structural flaw can make all that protection worthless when you actually need it.

You own investment properties; you set up an LLC online; you even signed a Living Trust. You probably believe your assets are protected. But a single paperwork error or structural flaw can make all that protection worthless when you actually need it.

Meaningful asset protection in 2026 requires more than signing documents. It requires proper structure, correct funding, and coordination with your insurance and tax strategy.

Our Yorkville estate planning attorney has over 20 years of experience helping clients build protection that actually works when challenged. Call Gateville Law Firm at 630-780-1034 for a consultation.

What Did the 2008 Financial Crisis Teach About Asset Protection?

The 2008 recession revealed which asset protection strategies held up under pressure and which collapsed. When real estate values crashed and creditors aggressively pursued judgments, many DIY structures failed because they had not been properly established or maintained. We were on the front lines trying to help desperate families protect their homes and assets. But as the L.A. Times reported, at least 10 million people lost their homes. That number is truly staggering.

How Aurora Families Can Master Risk Management in Estate Planning

Your family's legacy should provide security and peace of mind, not become a source of legal complications and financial stress. For Illinois families, not having a comprehensive estate plan opens the door to significant financial and emotional risks that could have been prevented with proper planning.

Your family's legacy should provide security and peace of mind, not become a source of legal complications and financial stress. For Illinois families, not having a comprehensive estate plan opens the door to significant financial and emotional risks that could have been prevented with proper planning.

Effective estate planning protects your family from three major threats through strategic risk management. These threats include:

-

Probate costs and delays

-

Devastating long-term care expenses

-

The potential loss of inherited wealth through divorce

According to a survey by senior living advisors at Caring, around 75% of Americans die without a will. You don’t need to be one of them. Our Aurora, IL estate planning attorney can help you understand the legal tools to address these risks. Call us at 630-780-1034 to schedule an appointment in 2026.

How to Avoid Catastrophic Probate and Guardianship Risk in Oswego

You've made the key decision to create a Revocable Living Trust, the cornerstone of a comprehensive estate plan. You signed the documents and feel protected with peace of mind.

You've made the key decision to create a Revocable Living Trust, the cornerstone of a comprehensive estate plan. You signed the documents and feel protected with peace of mind.

But here is a critical warning: Signing the trust document is only half the battle. A signed trust document is nothing more than an "empty bucket" of instructions until your assets are legally transferred, or funded, into its name.

An unfunded trust is a massive invitation to the very legal disasters you paid to avoid: Probate after you pass away, and an expensive, public guardianship proceeding if you become incapacitated.

The cost of this oversight isn't just a headache. It can easily exceed $50,000 in legal fees, penalties, and lost time for your family. Avoid this with the help of the Owego, IL estate planning attorney with Gateville Law Firm.

The Truth About Wills, Trusts, and Avoiding Probate

Most people believe having a last will and testament means their estate will pass smoothly to their heirs. They think a will protects their inheritance and avoids complications like fights over inheritance or making sure certain items get passed to specific people.

Most people believe having a last will and testament means their estate will pass smoothly to their heirs. They think a will protects their inheritance and avoids complications like fights over inheritance or making sure certain items get passed to specific people.

Unfortunately, the reality is more complex. Wills do not avoid probate; in fact, wills practically guarantee your estate goes through probate, which can significantly reduce what your beneficiaries actually receive.

Understanding the difference between wills and trusts, and how probate affects your estate, helps you make better decisions about protecting your legacy. For help with setting up a trust and other estate-planning priorities, call our Aurora, IL wills and trusts attorney today.

Second Marriages, First Mistakes: How Joint Tenancy and Poor Planning Can Disinherit Your Children

Blended families form when one or both partners bring children from a prior relationship into a new marriage or long-term partnership. These families include stepchildren, stepparents, half-siblings, and many relationships that the law does not balance on its own. Without clear and careful estate planning, it is easy for one set of children to be left out or even disinherited.

Blended families form when one or both partners bring children from a prior relationship into a new marriage or long-term partnership. These families include stepchildren, stepparents, half-siblings, and many relationships that the law does not balance on its own. Without clear and careful estate planning, it is easy for one set of children to be left out or even disinherited.

Most spouses in second marriages own their home as joint tenants or tenants by the entirety. In Illinois, both forms include a right of survivorship under 765 ILCS 1005/1c, which means the surviving spouse becomes the full owner at the first spouse’s death. But both forms still create the same blended-family problem – they can erase a child’s inheritance instantly.

Our experienced Morris, IL estate planning attorney at Gateville Law Firm can help you structure your estate plan so that everyone you want to care for is protected and difficult disputes over property and inheritance are not part of the picture once you pass away.

Gateville Law Firm

provides excellent estate

planning service.

"Sean's team is knowledgeable, responsive, and dedicated to ensuring clients feel confident in their decisions. Sean & Connie take the time to answer questions thoroughly, making complex legal matters easy to understand."

In Service of Your Wealth

If you own assets with a value in excess of $1 million, it is crucial to take steps to ensure that your wealth will be preserved and passed on to future generations. Failure to do so could lead to financial losses due to lawsuits, actions by creditors, or other issues. You will also need to be aware of potential estate taxes that may apply at both the state and federal levels. When working with our attorneys, you can make sure your wealth will be properly preserved.

Our estate planning team can provide guidance on the best asset protection options that are available to you. With our help, you can reduce the value of your taxable estate to ensure that more of your wealth will be preserved for future generations. We can also help you use asset protection trusts or other methods to make sure your property will be safeguarded. Our goal is to provide you with assurance that your family will be prepared for whatever the future may bring.

Blog

The Spousal Planning Trap: When Love Alone Isn’t Enough Protection

Posted on March 2, 2026 in Asset Protection & Wealth Preservation

Business Owners Beware: Why Your LLC Does Not Protect Your Family’s Personal Wealth

Posted on February 28, 2026 in Asset Protection & Wealth Preservation

Second Marriage, First-Class Mistakes: How QTIP Planning Protects Blended Families

Posted on February 23, 2026 in Estate Planning

|

Yorkville Office201 East Veterans Parkway, Suite 14 |

Sign Up for

Our Seminar

From our office in Yorkville, we provide services to clients throughout Kendall County, Kane County, DeKalb County, LaSalle County, Grundy County, and the surrounding areas, including Aurora, Big Rock, Boulder Hill, Newark, Ottawa, Joliet, Leland, Morris, LaSalle, Minooka, Montgomery, Plainfield, Plano, Oswego, Sandwich, Somonauk, Sugar Grove, Mendota, Earlville, Serena, Sheridan, Marseilles, Lisbon, and Plattville.

Results listed are not a guarantee or indication of future case results.